Homeowners depreciation calculator

A P 1 R100 n. Section 179 deduction dollar limits.

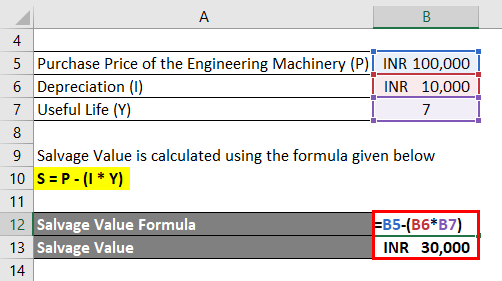

Salvage Value Formula Calculator Excel Template

Where A is the value of the home after n years P is the purchase amount R is the annual.

. The Depreciation Calculators are completely free for anyone to use and we hope that they provide the user with all of their needs. 500 - 505 which comes down to 90 depreciation per year. Using the above example your basis in the housethe amount that can be depreciatedwould be 99000 90 of 110000.

Your home policy has a 2000 deductible. Personal Items Depreciation Calculator The calculator should be used as a general guide only. Think about this.

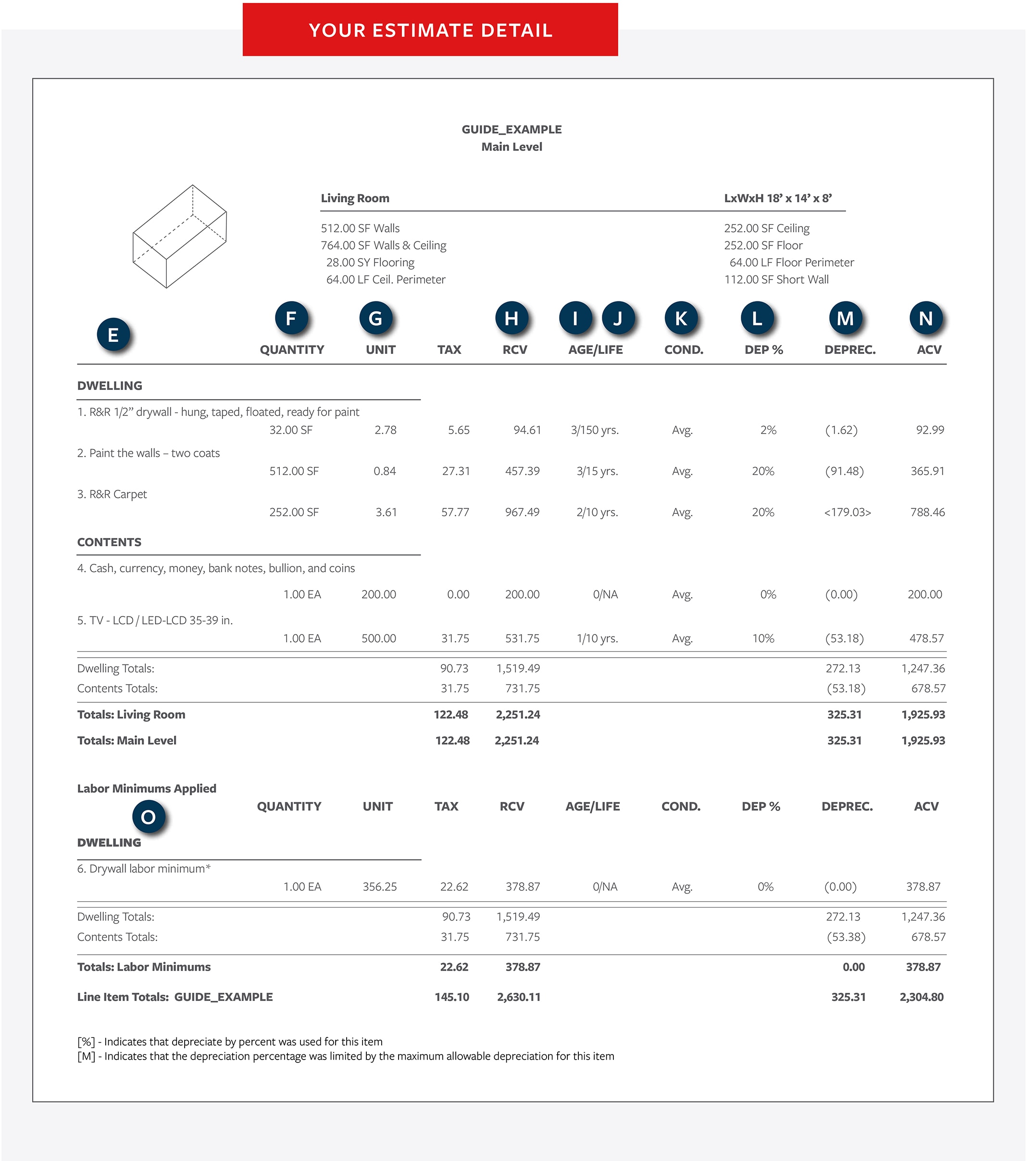

Under most insurance policies claim reimbursement begins with an initial payment for the Actual Cash Value ACV of your. Cost of asset salvage valueestimated useful life annual depreciation expense 600 1005 100 in annual depreciation expenses As for the residence itself. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000.

If an accident occurs five years into an established homeowners insurance policy the deck will be valued at 7500. A deck valued at 10000 might depreciate 500 per year. Thus the calculation would be.

Total Depreciation - The total amount of depreciation based upon the difference. If you have any questions about how they work or even have. This calculator performs calculation of depreciation according to.

Our property depreciation calculator helps to calculate depreciation of residential rental or nonresidential real property. According to a 2019 study the average new car depreciates by nearly half of its value after five years. Your basis in the land would be 11000.

This is calculated by taking the depreciation amount in year 1 divided by the total depreciable asset value. This loss in value is commonly known as depreciation. First enter the basis of an asset and then enter the business-use percentage Next select an applicable recovery period of property from the dropdown list Next choose your preferred.

There are many variables which can affect an items life expectancy that should be taken into. The home appreciation calculator uses the following basic formula. Real Estate Property Depreciation Calculator Calculate depreciation used for any full year and create a depreciation schedule that uses mid month convention and straight-line depreciation.

This limit is reduced by the amount by which the cost of. You have used the television for 3 years thus depreciation is at 270. Plus under your special clause you can also expect to receive the.

Your kitchen claim will get you 960 ACV payout. However different cars depreciate at different rates with SUVs and trucks generally. There are many variables which can affect an items life expectancy that should be taken into.

Furniture Depreciation Calculator The calculator should be used as a general guide only.

Salvage Value Formula Calculator Excel Template

How To Calculate Depreciation On A Rental Property

The Hidden Costs Of Selling Your Home Selling House Home Warranty Companies Real Estate Buying

Rental Property Calculator Most Accurate Forecast

Understanding Your Property Estimate Travelers Insurance

Mortgage Loan To Get Debt To Income Ratio Line Of Credit Home Equity

Straight Line Depreciation Calculator And Definition Retipster

Salvage Value Formula Calculator Excel Template

How To Use Rental Property Depreciation To Your Advantage

Straight Line Depreciation Calculator And Definition Retipster

Salvage Value Formula Calculator Excel Template

Understanding Your Property Estimate Travelers Insurance

Internal Rate Of Return Irr Formula Real Estate Investor Real Estate Investing Metric

Home Depreciation Simplified Guide Trusted Choice

Home Affordability Calculator For Excel

Appliance Depreciation Calculator

Home Ownership Expense Calculator What Can You Afford